On 7 December 2017, the Basel Committee of Banking Supervisors (BCBS) issued the last elements of the Basel III (also referred to as Basel IV) guidelines on bank capital reforms. The revision aims to restore credibility in the calculation of risk-weighted assets (RWAs) and to improve the comparability of capital ratios.

As stated before by the Bank of International Settlements (BIS), the reforms include revisions for the following elements:

• Standardised approach for credit risk

• Internal ratings-based approach for credit risk

• Credit valuation adjustment (CVA) framework

• Standardised approach for operational risk

• Leverage ratio and a leverage ratio buffer for global and systemically important banks (G-SIBs)

• Aggregate output floor, which will ensure that banks’ risk-weighted assets (RWAs) generated by internal models are no lower than 72.5% of RWAs as calculated by the Basel III framework’s standardised approaches.

The European Banking Authority (EBA) forecasted that the output floor of 72.5% will increase to an average 12.9 percent of capital for EU banks and a 15.2 percent for the 12 largest banks, taking 2015 balance sheet as an example.

The output floor will serve as a safety net to Financial Institutions that are currently using internal risk-based models to calculate capital buffers. European banks however, tend to hold more long-term assets on their balance sheets.

In 2010 BCBS gave Basel III a seven year implementation period. For the upcoming guidelines, BCBS delayed the implementation from 2019 to 2022. Additionally, the Group of Central Bank Governors and Heads of Supervision (GHOS) has extended the implementation date of the revised minimum capital requirements for market risk, which were originally set to be implemented in 2019. Now the date has been changed to January 1st 2022.

As a niche consultancy firm, FiSer Consulting finds it important to define strategies that equip Financial Institutions with the capabilities to solve regulatory issues but also to maximise value in the implementation process with the help of:

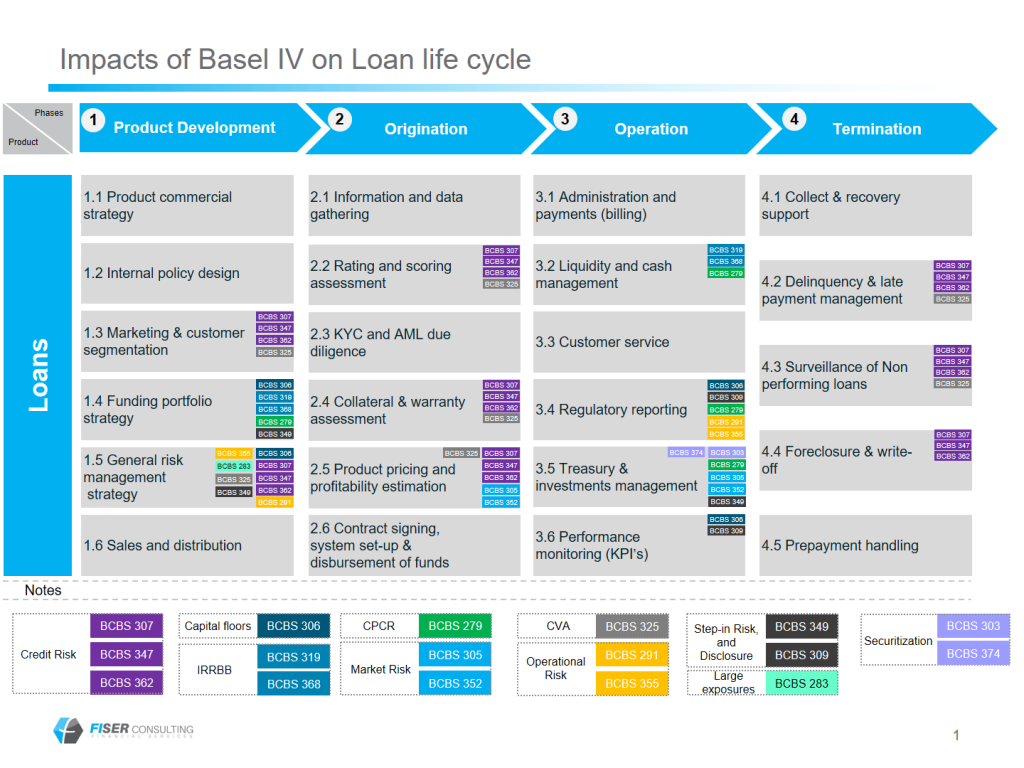

1. Identifying key touchpoints where BCBS’ final papers (Basel IV) will create a significant impact.

2. Create a “Product life cycle analysis”. This analysis aims to provide a holistic view of the impacts across the four stages and processes of a financial product (for example a Retail Loan).

3. Conduct an assessment within the organisation using our “Basel IV readiness questionnaire”. This questionnaire will determine whether there are significant gaps between current Basel program versus the new requirements.

4. Determine a strategy and roadmap for implementation

When utilising these tools, we can make sure that an organisation achieves a smooth and complete Basel implementation.

At FiSer Consulting we are keen to understand your organisation and to bring the correct tools to implement any regulation. If you are interested in discussing the possibilities, please contact us at info@fiser.consulting.

Information in this article was deducted from the official page of the BIS and the Financial Times (dated 08/12/17).